The Mangata Playbook - Part 3: Tokenomics

This post introduces you to the Mangata X Tokenomics. First we will give you a summary, then we go into a deep dive to explain our thinking behind it.

Watch the video to this article:

Tokenomics Summary

Ticker, Initial Supply, Hard Cap

The ticker of the native token of Mangata X will be $MGX. At TGE, it will have a total supply of 1bn MGX. Rewards will be issued up to a capped supply of 4bn MGX, which will be reached at the earliest in 5 years. 80% of the final supply of tokens are reserved for the community.

Utility

The core utilities are:

- Usage in Proof-of-Liquidity

- Algorithmic buy & burn

- Governance: Managing the diversified Treasury & DEX-owned liquidity, Liquidity Incentives, Proof-of-Liquidity Whitelisting

Exchange Commission & Fees

The Exchange Commission on trades is 0.3%, of which

- 0.2% go to liquidity providers,

- 0.05% to the Treasury

- 0.05% are used for algorithmic buy & burn.

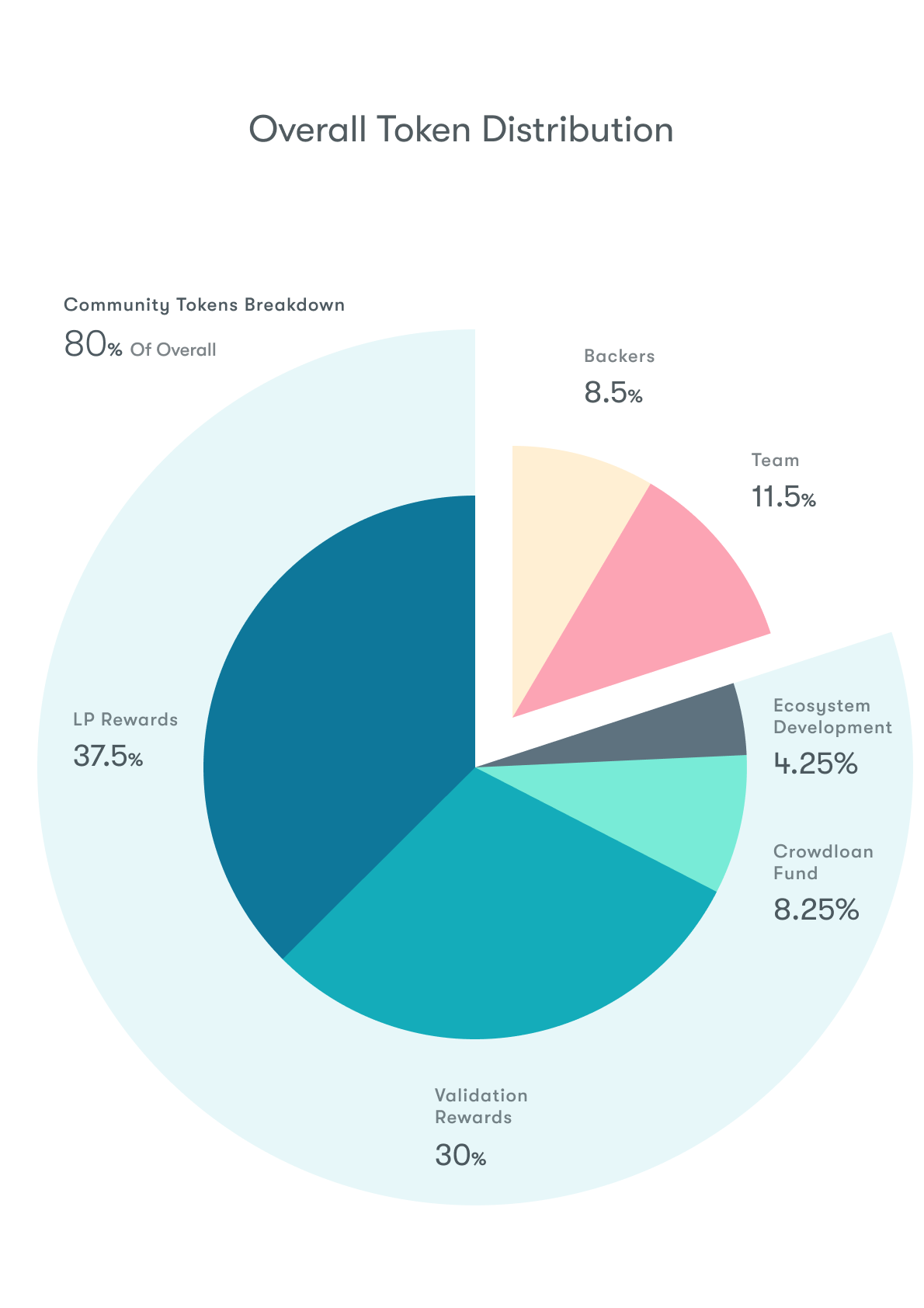

Token Distribution

80% of all tokens are allocated for the Community, with the main portions allocated for securing the network and providing liquidity. The rest of the community portion is awarded for supporting the network via crowdloans and other activities.

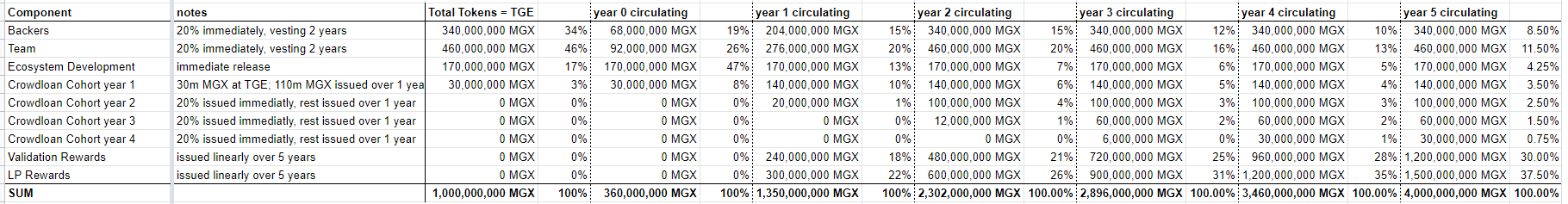

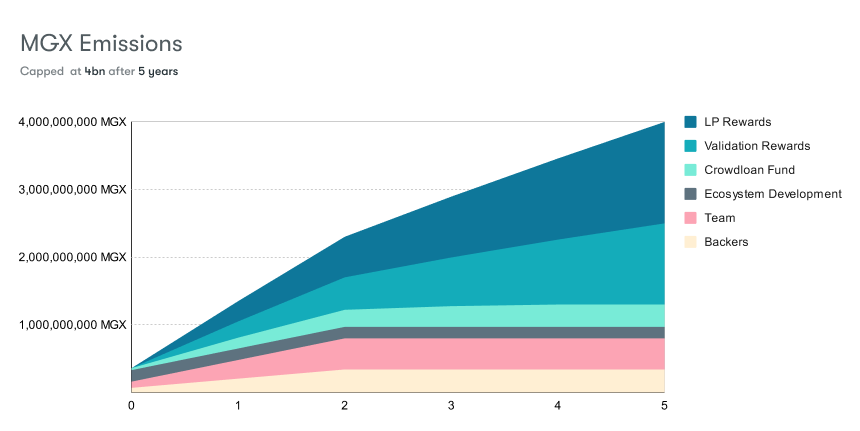

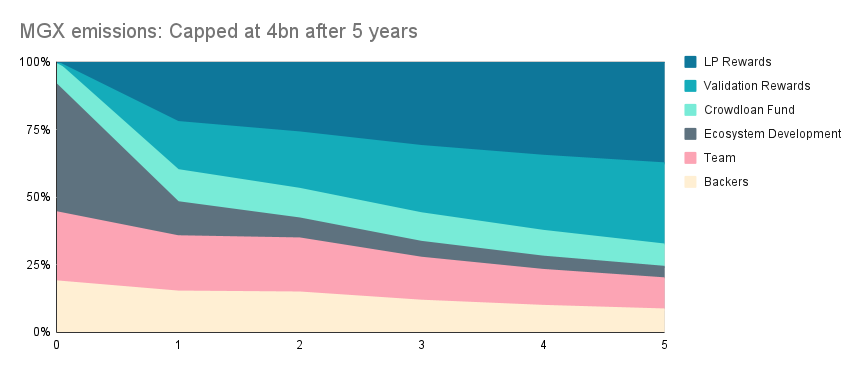

Emission Schedule

The token emission schedule will reach the capped supply earliest after 5 years. Algorithmic Buy & Burn can push this date back into the future.

Below you can find a projection of the circulating supply until the hard cap is reached:

This chart shows the projected circulating supply:

This chart shows the projected distribution schedule:

Deep Dive

How do you construct Tokenomics? Whom do you reward? What do you pack into the utilities? In this post, we will dive a little deeper into the logic of how well-rounded Tokenomics are created.

“What is the utility?”

It is one of the most heard questions when a new token is introduced. And it makes sense: Every project, protocol and parachain is solving specific problems. For a parachain, a token is like a medium to reward behavior that supports the network in the long term. The fundamental value that a token has is determined by its utility: The problems it allows us to solve.

What Problems is Mangata solving?

Let’s look into our solutions to get an understanding for the utility that MGX will have:

- front-running and MEV: These are some of the most fundamental problems we are solving and the ones that give Mangata a unique position in crypto. We have a working solution ready to deploy: Themis Protocol

- native tokens locked in staking: This is a problem for every chain but would be even more so for a DeFi-oriented chain. This is why we are leveraging a revolutionary mechanism to unlock capital for staking: Proof-of-Liquidity

- low liquidity: a problem that every DEX has to solve and that can be covered to a great degree with liquidity mining

- liquidity leaving: liquidity that is shuffled around different pools or leaves the DEX altogether is a common problem for incentivized DEXes. To give liquidity a reason to remain more calm, we introduce time-incentivization on liquidity mining and DEX-owned liquidity

- inflation from incentive rewards: a lot of projects suffer from an unclear strategy on inflation. At Mangata, you get predictability: We introduce a hard cap on token supply

- negative effects from diminishing incentives: hard-capping the supply usually leads to diminishing incentives and capital moving to the next problem. As we need continued incentives for securing the network in proof-of-liquidity, we are introducing algorithmic buy & burn to continuously add deflationary pressure

MGX Utilities

From these problems and solutions, we arrive at MGX Utilities:

- use in Proof-of-Liquidity staking to secure the network: as this activity is also incentivized, there will be strong demand to provide liquidity for collator nodes.

- liquidity base layer: as a lot of liquidity concentrates around MGX, this will offer a lot of short trading routes through MGX, establishing a base layer of liquidity.

- algorithmic buy & burn: to continuously offer validation rewards to secure the network against front-runners, we take a small part of the exchange commission to buy & burn MGX.

- Governance: managing the diversified treasury and DEX-owned liquidity, as well as liquidity mining incentives and validation rewards will be political task that creates demand for liquid MGX

Distribution Charts: The Activities Mangata incentivizes

Our token distribution chart shows the kind of activities we want to see in the network to happen. 80% of the final supply after 5 years go into the hands of the community.

- LP incentives: As traders are the most important stakeholder group, the thing they need most is deep liquidity to perform high volume trades. This is why we are incentivizing liquidity provision with 37.5%.

- Validation Rewards: Securing the network against front-running and MEV is one of our most important promises. To make sure there is a lot of competition around this activity, 30% of tokens will go to collators and delegators.

- Crowdloan Rewards: To help us secure a spot in the ecosystem, crowdloan rewards over the first 4 slot periods get 8.25% of the final supply

- Ecosystem Development Fund: To incentivize all sorts of activities that the community can do to support the network, the Ecosystem Development Fund will receive 4.25% of tokens to reward community activities.

- Team: To support continued development of the Parachain, we have reserved 11.5% for the team.

- Backers: The early supporters of the network will hold 8.5% of the final supply.

May the Airwhale bless you with infinite rewards!

Stay tuned for the blog updates

Subscribe to the newsletter and follow Mangata on social media.