The Mangata Playbook - Part 1: Begin with the End in Mind

Fellow Pioneers,

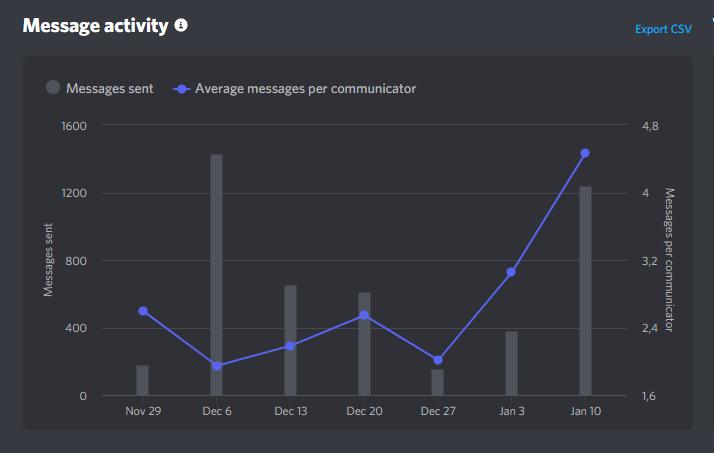

After we shared our Mangata X Announcement at the end of 2021, the growth of our community started snowballing. New Pioneers joined our social media channels and especially the Mangata Discord. We wanted to begin the year casual with an off-the-records Mangata Monday community call and no big announcements. but to our joyful surprise more than 50 people showed up. They had seen the Mangata X announcement and now wanted to hear it for themselves. Mangata Monday turned into an AMA around Themis Protocol, Proof-of-Liquidity, our collator program and much more… and one realization set in: The Mangata Community is lifting off!

As more people are joining our community now every week, they are learning about the Mangata and develop a shared mental model about capital efficiency and fairness and how to build a chain around it from the ground up. This is awesome and challenging at the same time. It means that we have to spend a lot more time to explain fundamentals and the building blocks that make Mangata so awesome.

To make it easier, we have decided to write the definitive guide on what Mangata is and how we plan to create a winning product, token and community: The Mangata Playbook.

The Mangata Playbook will start as a 4-part series of blog posts and later become part of the core docs. We hope it helps you understand the revolution we are building. If you have any questions, hop into Discord and have a chat with us!

Watch the video to this article:

DeFi is broken

It has been broken before it was even built. Ethereum was launched in 2014. Back then, transactions were not designed to be private or cheap. They were designed to just work. The consequences are hurting us today:

- Rising gas costs make cost-averaging or more sophisticated trading strategies expensive and are pricing out smaller traders from many markets.

- Bots and Nodes are stealing from honest traders. Users are forced to pay extra to be protected, often chosing private mempools that hide transactions from the public. This orients the node economy around MEV. Read more about it in our article: Miner Extractable Value - The Biggest Thorn in DeFi

Slowly but surely this creates an imbalance in the way smaller and bigger traders are getting returns in DeFi. The power balance shifts and creates new forms of centralization. The original promise of a permissionless financial system where everyone is treated equally is broken. DeFi is broken.

But it does not have to be this way. Ethereum’s EVM is not the only way to do blockchain. We set out to find better solutions.

This is the vision that unites us at Mangata: To solve the big issues of DeFi.

In order to do this, we have to start at the very core: Creating a DEX that is as optimized as possible for trading. Efficient, cheap, easy & equitable. All tokens from all networks. This is our first mission. We invite you to become part of the journey.

Let’s fix DeFi together!

In the Beginning there was Liquidity

How do you create a successful DEX? Is it about the tech? About the token? About network effects?

In the summer of 2020, DeFi builders seem to have discovered the silver bullet: Liquidity Mining. It compensates liquidity providers for impermanent loss by giving them tokens as rewards. This simple idea worked wonders. Floods of capital were flowing into liquidity provision. It unlocked the growth for DEXes and finally kickstarted the era of DeFi in crypto. It became known as “DeFi Summer”.

The DEX Playbook

Every week, you can see “The DEX Playbook” being used by a new DEX:

- Make a DEX

- Provide rewards with insane APR to build deep liquidity pools

- Profit

The theory behind the DEX playbook is: Get too big to fail. Even when rewards end, some of the liquidity will stick.

Sadly, what once worked is no longer a guaranteed way to success. More often than we would like to see it, the Struggling DEX Playbook runs a little bit different:

- Make a DEX

- Provide rewards with insane APR to build somewhat decent liquidity pools

- Mercenaries come and go

- Run into token issues

Great rewards come with great responsibilities. Token devaluation from high emissions, the struggle to keep liquidity when incentives are dropping and questions on the fundamental value of a DEX token can damage the image of even honest teams and put the future of their project at risk.

To make things worse for honest projects, a neverending stream of low-effort Uniswap forks are popping up every week that are running the Scam DEX playbook themselves:

- Fork a DEX, adjust for maximum ruggability

- Provide rewards with insane APR to attract greedy investors

- Sell as much as possible from your useless shit token

- Rug

This creates a situation where honest new DEXes have a hard time making their case in an environment where seemingly no one can really be trusted.

It leads us to the main question of this article: How can we create a successful DEX?

What should the Mangata Playbook look like to win the game in this environment?

The Mangata Playbook

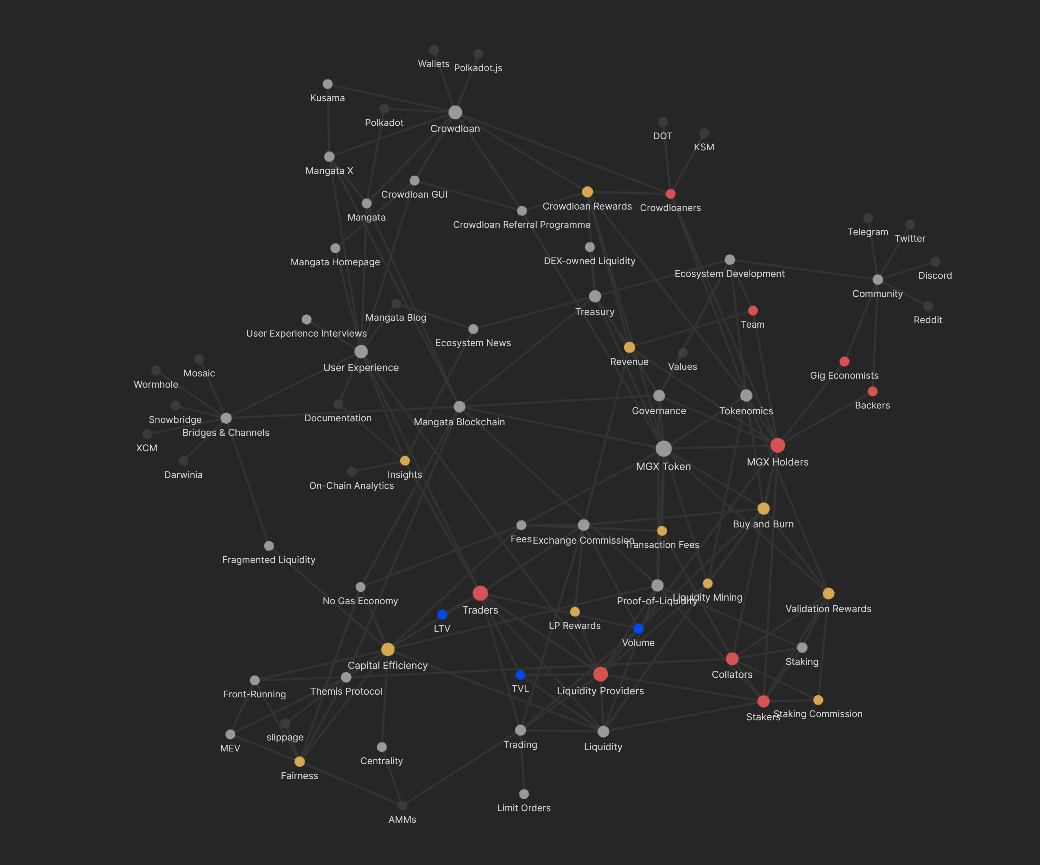

This chapter will show you our gameplan. Very briefly, it is:

- The Endgame is Capital Efficiency

- The Way to get there is Fairness

- Fundamental Values First

- Strong Tech

- Strong Tokenomics

- Strong Network

Let’s begin with something obvious: No one needs a new DEX… If it does not add any value to DeFi. There are already enough DEXes. Forking the same codebase with the same roadmap and the same marketing tactics that we already have seen dozens of times? No. That’s not the way to go! Instead, we do what needs to be done and add value.

So where do we add value? By fixing the biggest issue in DeFi, the holy grail: Capital Efficiency. Paying less to get more. We believe the endgame of DeFi will be decided on this metric.

At the same time, capital efficiency is not worth anything if it is achieved by shifting the power balance towards a few centralized actors. We want a level playing field for everybody. Our DEX is built on the premise of Fairness.

The Goal: Winning the Endgame of DeFi with Capital Efficiency

99% of all DEXes you encounter have gas fees. Why? Aren’t you already paying 0.3% exchange commission? Because the chain is programmed to ask you for gas? No matter which chain you are using, you most certainly are paying gas fees which add to the cost of trading.

One thing is certain: When all DEXes have played their cards and all other matters are equal, the winner will be the DEX that is the most capital efficient. Network effects will always reward the product where you pay less to get more.

The Tech: You can’t fork Capital Efficiency

By this definition alone, 99% of all DEXes you encounter won’t matter in 5 years. You won’t think about them any more, just like you might not think a lot about Ethereum Classic or Bitcoin Cash today.

Instead, we are going to build better tech. New innovations that improve upon the previous ones. When it became obvious that we can’t overcome the limitations that the Ethereum EVM brings, we decided to build a DEX-chain with the cutting-edge Substrate tech stack. It allows us to change the rules of the system and optimize them for our use case.

Let that sink in: A blockchain optimized for capital efficiency!

A customizable blockchain allows us to solve the big issues of DeFi: front-running, MEV, gas costs, privacy issues, locked capital, etc. A Substrate chain is also a DAO out of the box. We don’t need to shoehorn that in at a later point in time.

By going for a customized chain, we are setting up our DEX to become successful in the long run and win the endgame. Which brings us to the second issue: Too many projects have delivered superior tech but did not grow large enough to enjoy the fruits of their success. To win long-term, we also must win the whole journey. This is where tokenomics and networks come into play.

In Part 2 of The Mangata Playbook, we will introduce you to the Tech that has developed from these realizations.

Tokenomics: Facilitating long-term growth of the DEX

The token of a network can be viewed as a medium to reward behavior that supports the network. That is why tokenomics are extremely important. They have to consider the bootstrapping, the growth and the stability phases of the product.

Tokenomics also have to make sure that the price dynamics stay favorable over all time frames and token price is not too negatively affected by early sellers realizing their gains.

We found a way to have a capped supply and still offer infinite rewards by implementing algorithmic buy & burn. This, combined with our ambition to enable the treasury to aquire DEX-owned reserves & liquidity will allow our ecosystem to grow steadily while rewarding early investors.

In Part 3 of The Mangata Playbook, you will learn about Mangata Tokenomics.

Networks: Building a Community and relationships with other Protocols

The Community and relationships with other protocols and ecosystems is what decides on the fate of any project. That is why we are prioritizing community building more than many other projects with weekly community calls, focus on scaling work via the community and reward contributions via the Treasury.

Active Governance and Active Treasury Management also mean, that we have to rely on the collective wisdom of the community to make the right investment decisions together. Wether this means accumulating enough KSM and DOT to self-fund parachains or if it means to invest in other protocol tokens to participate in their governance. We believe the creating a web of protocols that are invested in each other gives all of us more security for future macro bear markets.

In Part 4 of the Mangata Playbook, we show your our initial concept on the Networking strategy and invite you to become part of Mangata governance.

Conclusion

We believe that that success comes when you begin with the end in mind. What will be your Endgame and what is the Way you chose to get there? Too many projects focus on only one of those three factors: Value-adding technology, rewarding tokenomics and a networking strategy. But only when you consider all of them can your project be successful in the competative environment that crypto is becoming.

We want to solve the big challenges of DeFi and this requires that we gather big minds who solve the challenges that we are presented with together.

We invite you to be part of the journey… be a Mangata Pioneer and let’s be there together when we begin to venture into DeFi 3.0 and beyond.

May the Airwhale bless you with infinite rewards!

Stay tuned for the blog updates

Subscribe to the newsletter and follow Mangata on social media.