Earn a Living - Run a Mangata Node

This is a post about how centralizing network effects are marginalizing individual node operators and how this puts the decentralization of the whole blockchain ecosystem at risk. We summarize our thoughts, research and results from community calls. And we will show first building blocks to solve the issues and the path we want to take to fix this.

At the end of the post, we will invite you to become part of the solution and earn a living by running a node for the Mangata blockchain.

Earn a Living - Run a Mangata Node

We wouldn’t have the revolution that is Crypto without one specific group of people: Node Operators.

Node operators provide the compute that serve as the backbone for all of our blockchains. Node operators are the reason we have decentralization. Node operators make it possible that we have secure, censorship-resistant, tamper-proof, publicly auditable systems that build the base for secure transactions, dapps, decentralized finance, the metaverse and more.

But these independent node operators and our decentralization are threatened by centralizing effects that span all blockchain ecosystems from Bitcoin over Ethereum to Polkadot. The same network effect that made Bitcoin and Crypto big is also putting it at risk by creating economic incentives for larger players and marginalizing individual validators.

Marginalizing individual node operators is a systemic risk we need to face!

If nodes are centralized into to hands of very few big entities, our revolution is at risk. We believe that decentralization can only be secured by making sure that independent node operators stay profitable and can focus on providing security for all of us.

In this article, we describe how proof-of-work and proof-of-stake systems are both affected and how we at Mangata want to tackle those issues for our blockchain by creating a system of decentralizing incentives.

The Problem: Marginalization of individual node operators

Most blockchain networks create an arms race for node operators to reduce operating costs as much as possible. This creates a situation where many node operators are eventually forced to ask for less and less rewards in order to stay competitive. While this is efficient for the market, it also leads to centralization as the node market converges to a few mining pools. This problem can be observed even on the biggest blockchain networks like Bitcoin and Ethereum.

The Reason: Centralizing effects on Bitcoin, Ethereum and Polkadot

Proof-of-Work, Bitcoin & Ethereum

Bitcoin changed the world by introducing Blockchain technology. The node operators of Bitcoin - Miners - played one of the most crucial roles in this process: They were the first to take on the work and risk of running a node. They were rewarded for securing the network by earning block rewards. Thousands of tinkerers heated up their graphics card and started mining. It was a prime time, when a single human could directly mine Bitcoins.

Over time, the hashrate required to mine a single block became so high that no individual node operator could hope to mine alone and ever have the chance to find a single block and get rewarded. Thus, mining pools were born, where everyone could direct their hash power to a pool that would gather the hashrate, mine blocks and share the rewards.

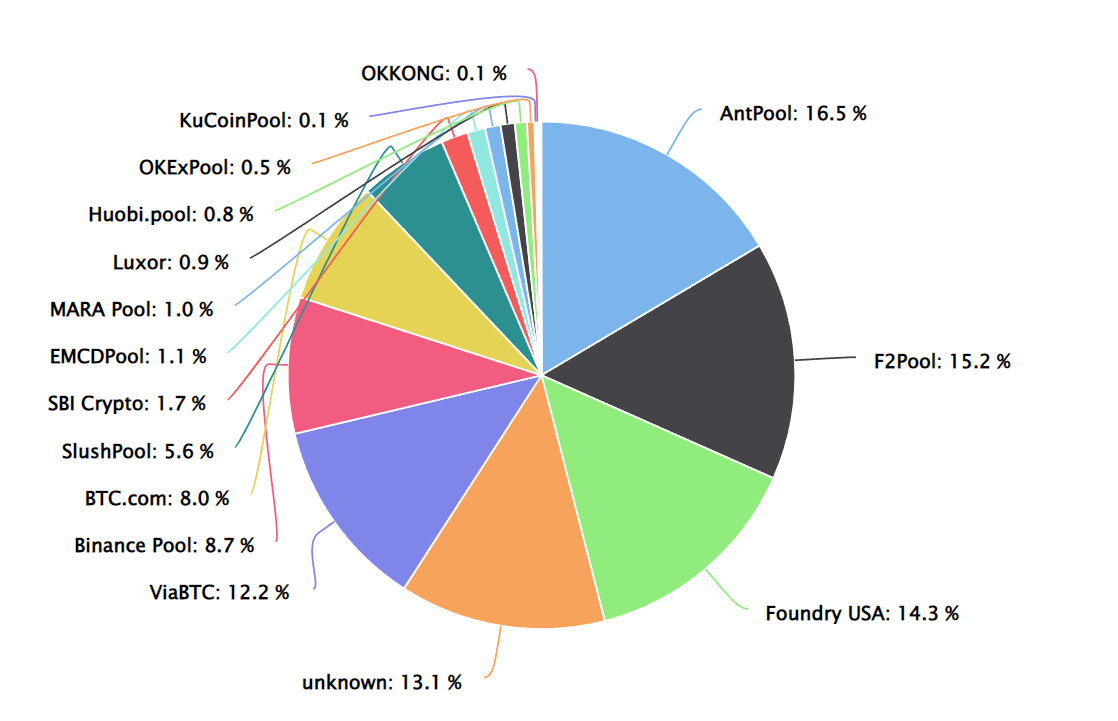

(Source: https://btc.com/stats/pool?pool_mode=month)

The result is that the 4 largest Bitcoin mining pools take over 50% of the hashrate. A centralization clear risk!

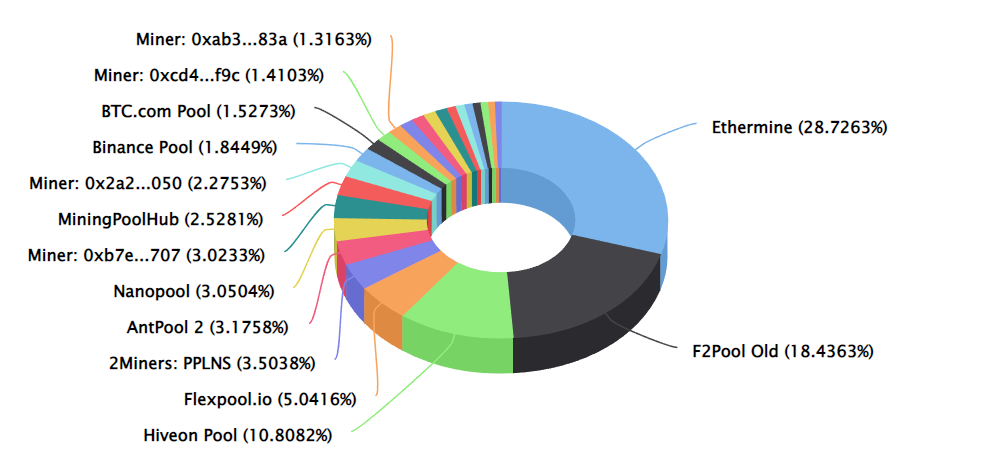

For Ethereum, the issue is magnified and just 3 pools control over 50% of the hashrate:

(Source: https://etherscan.io/stat/miner?range=7&blocktype=blocks)

If those pools become compromized (for example by government agencies or competing entities gaining control over them) the security of the overall blockchain ecosystem might be compromised.

Proof-of-Stake, Polkadot

Will Proof-of-Stake be different? It doesn’t look like it, but plays out a bit different.

In Proof-of-Stake, block production is not bound to raw processing power, but rather to the capital someone is ready to put at stake for securing the network instead. While this saves a lot of energy and is more carbon-friendly, it doesn’t save us from centralization effects.

We are currently witnessing this in the Polkadot und Kusama ecosystems. In a recent Mangata Monday community call with node operators, we were shown how this is currently playing out.

Kusama recently increased the number of active validators from 900 to 1000. You would tend to think this increases decentralization and the security of the blockchain, but this might not have been the case.[https://t.co/rN0IZCi7JM](https://t.co/rN0IZCi7JM)

— Mangata (⚖️,⚖️) (@MangataFinance) November 24, 2021

Some node operators are already overwhelmed and fall back to only relying on support programmes for validators. We can’t blame them. Others are picking up the fight and try to change the rules via governance.

Staking enterprises that can afford the capital to have nodes nominated in Proof-of-Stake are gaming the selection algorithms to maximize their income. We understand why it is logical for them to do so, we also acknowledge the problem that smaller node operators are being pushed out of the system bit by bit.

This is not in the spirit of blockchain technology itself, which is to allow for as much decentralization as possible to mitigate the risk of censorship and manipulation.

How can we stop that trend?

The Solution: Making sure that individual node operators can earn a living

At Mangata Finance, we are building an app-specific DEX parachain for the Polkadot and Kusama ecosystem. This gives us access to a special superpower: We can change the rules of the game! We can build new consensus rules and governance systems.

We can devise a system that learns from the mistakes of the past, incentivizes decentralization and invites individual node operators to become part of the journey.

Mangata is here for the long run. We aim for progressive decentralization on all layers. This also means that we are very serious about building a strong base of decentralized node operators that secure our network. We think that one best ways to do this is to make sure they are properly incentivized to remain part of our ecosystem.

We started holding community calls with node operators to talk about reward structures that allow them to have a clear perspective on what is required from them and offered in exchange. Node operators need to know:

- What skills/hardware/software/investment does it take to become a Mangata node operator?

- How much will you earn per year?

- A clear perspective and time estimate (runway) on how long operators will be able to stay in business.

The intermediate result of this talks made two things clear:

- It will not be easy to create a system that migitates marginalizing network effects.

- Only active governance of the community can ensure that we adapt the system over time to consider new influences and metagaming.

It is clear that the market will always strive to reduce costs and a properly incentivized blockchain will attract a lot of competitors. But at Mangata we believe governance gives us the ability to provide a proper framework that allows everyone to make an informed decision about if they want to wager that bet or not.

Only when node operators are properly rewarded by the system, they can afford to spend time on governance and building a shared mental model about decentralization-incentives that make our ecosystem sustainable in the long term.

Building blocks towards a sustainable income for node operators…

A simple idea: Could we put a price tag on what the minimal staking reward per year is? We hope so. Do we know for sure? Not yet. Every system that offers incentivizes invites players who just try to game and drain the incentives as much as possible and return as little as possible. That is not what we want.

We are looking for honest operators who want to free up time to tinker with our blockchain, constantly improve it and build our long-term vision together. Those are the people we want to inventivize.

We want to lay out first building blocks that we see as crucial:

Proof-of-Liquidity: Stake once, earn twice

A first avenue is to open up new income streams for node operators. Usually capital holders have to decide if they invest their capital in staking or liquidity provision. At Mangata, we created a revolutionary new staking mechanism that allows stakers to stake their LP tokens, freeing up capital to create deeper pools and at the same time creating deeper liquidity.

For node operators, this means that self-stake also profits from trading fees and liquidity mining rewards.

You can read more in this blog post on Proof-of-Liquidity.

Tokenomics that support node operators

Node operators should earn a significant portion of the network. This will keep them invested and aligned with the incentives of other ecosystem users like traders and liquidity providers. This is why we plan to use 45% of tokens for staking rewards and liquidity mining, which node operators can profit from with their self-stake and comission.

Moving forward: Become a Mangata node operator

We are presenting this model to you today to show you what our offer to node operators is. We want to be very clear on this: When we say “earn a living”, we mean “earn a living”. We plan to align this concept with our tokenomics and reward parameters to really allow everyone who becomes a Mangata Collator to be able to live from the rewards.

We will launch our closed beta testnet in January. If you want to be part of this journey, join us! Fill out this form:

Apply to become a Mangata Collator

We invite you to become part of this journey to explore new decentralization perspectives. We invite you to become a Mangata Pioneer!

FAQ

Does the Mangata network require Validators or Collators?

Mangata has Collators as defined in Substrate terminology.

What software do node operators need to run?

Collators are based on the codebase provided by Substrate and are similar to other Parachain Collators.

Is the source code accessible?

You can look at the source code in our Github repository: https://github.com/mangata-finance/mangata-node

What are the Hardware Requirements?

We expect the Hardware Requirements to be similar to other Substrate Collators: 4 CPUs, 8-16GB RAM, NVME storage.

We will publish more information on that soon.

How will liquidity be provided to nodes?

You will need to hold both assets. We expect to use the Polkadot.js Portal to facilitate the actual process of staking.

What is the minium self-stake? What will the returns be?

We cannot answer that for you yet.

Stay tuned for the blog updates

Subscribe to the newsletter and follow Mangata on social media.